Such materials, called indirect materials or supplies, are included in manufacturing overhead. Indirect materials are materials used in the manufacture of a product that cannot, or will not for practical reasons, be traced directly to the product being manufactured. In this agreement, a tenant pays a single, all-inclusive rent expense that covers the base rent and all operating expenses, including utilities, property taxes, insurance, and maintenance.

Meaning of PTO: What is Paid Time off for Employees and Employers?

Integrate financial data from all your sales channels in your accounting to have always accurate records ready for reporting, analysis, and taxation. See it in action with a 15-day free trial or spare a spot at our weekly public demo to have your questions answered. Depending on the type of business, the cost of goods sold can be much easier or much more difficult to calculate.

Period Cost vs Product Expense

Vancouver has the highest average rent in Canada at $2,945, with a one bedroom renting for $2,624. Toronto is second with an average rent of $2,642 in October, while a one bedroom rented for $2,397. Across Canada, the average asking rent for all residential property types was $2,152 in October, down 1.2 per cent from October 2023.

What is the approximate value of your cash savings and other investments?

Depreciation represents the loss in value of fixed assets like machinery and equipment as they wear down over time. Depreciation is considered a fixed cost since the same amount is expensed every period based on an asset’s useful lifespan – changes in production do not impact the depreciation amount. These costs are expensed immediately on the income statement rather than being included in the costs of goods sold.

Rents for one-bedroom apartments in Ottawa increased to $2,045 a month in October from $2,042 a month in September. Some locations Starbucks owns; at others, Starbucks enters into leases to operate its retail locations. It means that DM and DL increase as production increases, and they decrease if production decreases as well.

- We’re a headhunter agency that connects US businesses with elite LATAM professionals who integrate seamlessly as remote team members — aligned to US time zones, cutting overhead by 70%.

- Examples include production materials consumed in making a product and commissions paid to salespeople.

- In other words, they are expensed in the period incurred and appear on the income statement.

- Freight costs can be categorized as either a product cost or a period cost, depending on the context.

That is, the rents will be included in the manufacturing overhead which is allocated to the goods produced. When the items in inventory are sold, the manufacturing rent allocated to those products will be expensed as part of the cost of goods sold. These rents are not allocated to products for its external financial statements. When preparing financial statements, companies need to classify costs as either product costs or period costs. We need to first revisit the concept of the matching principle from financial accounting. Understanding period costs helps assess the day-to-day financial health of a business.

And while product costs focus on the creation of goods or services, period costs represent the broader expenses necessary to sustain the business’s overall operations and facilitate growth. Period costs are hard to pinpoint to the business’s main products, but they are incurred nonetheless because they’re essential. Examples of period costs include rent and utilities of admin offices, finance charges, marketing and advertising, commissions, and bookkeeping fees.

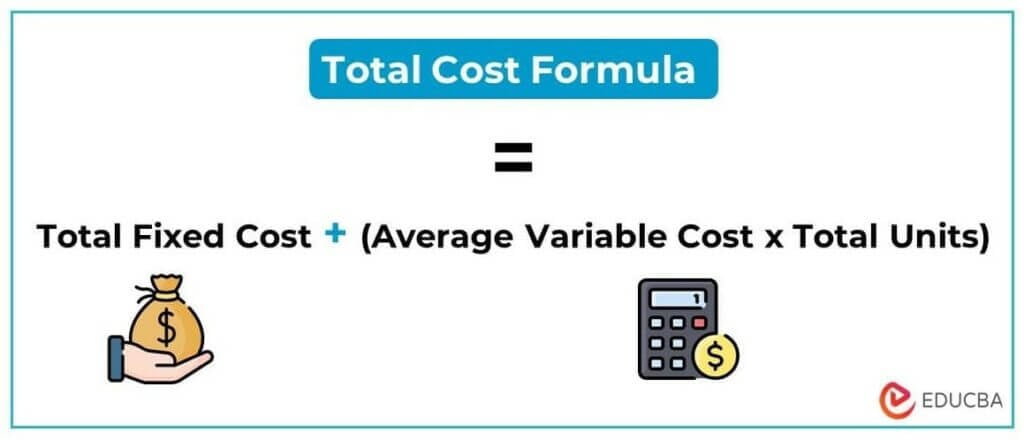

If the accounting period were instead a year, the period cost would encompass 12 months. Direct materials are those materials used only in making the product and there is a clear, easily traceable connection between the material and the product. For example, iron ore is a direct material to a steel company because the iron ore is clearly traceable to the finished product, steel. In turn, steel becomes a direct material to an automobile manufacturer. Product costs are sometimes broken out into the variable and fixed subcategories.

A period cost is charged to expense on the income statement as soon as it is incurred. Manufacturing companies typically spend low amounts in rent expense as a percentage of total expenses. Rent expenses for manufacturing operations are included in factory overhead, while rent is rent a period cost not tied to production—i.e., administrative office space rent—is charged to operating expenses. In real estate, location is usually the most important factor in the price of rent. Such materials are called indirect materials and are accounted for as manufacturing overhead.

Yes, corporate rent expenses are generally tax-deductible for businesses. The IRS allows companies to deduct ordinary and necessary business expenses, which include rent payments, from their taxable income. By deducting rent expenses, companies can reduce their taxable income, which in turn lowers their overall tax liability.

Period costs and product costs are two important concepts in managerial accounting that classify costs to analyze financial performance. Most business owners would agree that properly classifying costs as either “period” or “product” expenses is critical for accurate financial reporting and strategic decision making. Product costs are often treated as inventory and are referred to as “inventoriable costs” because these costs are used to value the inventory. When products are sold, the product costs become part of costs of goods sold as shown in the income statement.