Accounts payable (AP) turnover measures how fast a company pays its bills, used by both finance teams and lenders as an indication of financial health. Learning how to calculate your accounts payable turnover ratio is also important, but the metric is useless if you don’t know how to interpret the results. A company with a low ratio for AP turnover may be in financial distress, having trouble paying bills and other short-term debts on time. Use graphs to view the changes in trends as the economy and your business change.

- Net credit purchases are total credit purchases reduced by the amount of returned items initially purchased on credit.

- For example, a higher ratio in most cases indicates that you pay your bills in a timely fashion, but it can also mean that you are forced to pay your bills quickly because of your credit terms.

- A one-month period will have a lower AP turnover ratio than a three-month period, assuming your accounts payable process doesn’t change drastically between the two.

What Your AP Turnover Ratio Means

As a rule, vendors and other potential creditors will have different high-ratio and low-ratio benchmarks for your monthly, quarterly, and annual AP turnover ratios. Whether your accounts payable turnover is 10 key bookkeeping tips for self-employed and freelancers high or low depends on the time frame you’re considering, your industry, and your current financial strategy. Your suppliers take note of your timely payments and extend your terms to Net 30 and Net 45.

Understanding the Accounts Payable Turnover Ratio

Suppose the company in question has not renegotiated payment terms with its suppliers. In that case, a decreasing ratio could show cash flow problems or financial distress. But, since the accounts payable turnover ratio measures the frequency with which the company pays off debt, a higher AP turnover ratio is better. It is important to note that a high accounts payable turnover ratio may indicate that a company is paying its suppliers too quickly, which could lead to cash flow problems.

How To Increase Your AP Turnover Ratio

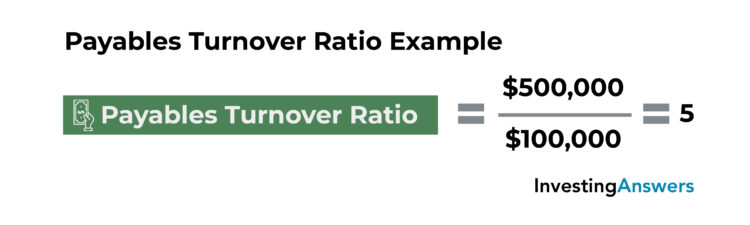

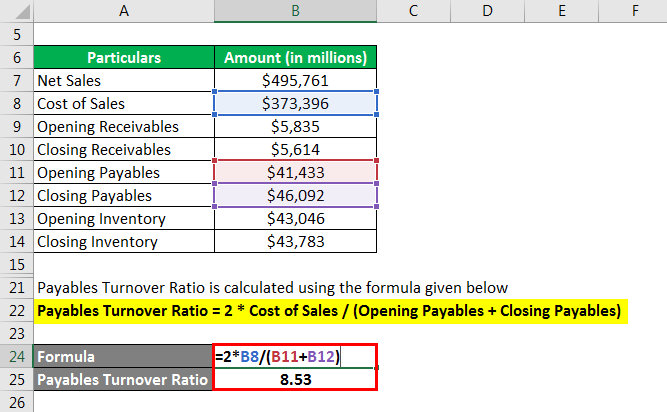

It means the company has plenty of cash available to pay off its short-term debts in a timely manner. This can indicate that the company is managing its debts and cash flow effectively. To calculate your accounts payable turnover ratio, you’ll need to know your starting and ending AP balance.

If your AP turnover is too low or too high, you need a ratio analysis to identify what’s causing your AP turnover ratio to fall outside typical SaaS benchmarks. You also need quick access to your most important metrics without taking valuable time entering them manually into Excel from different source systems and financial statements. SaaS companies can find the right balance by tracking their accounts payable turnover ratio carefully with effective financial reporting.

But in the case of the A/P turnover, whether a company’s high or low turnover ratio should be interpreted positively or negatively depends entirely on the underlying cause. Instead, investors who note the AP turnover ratio may wish to do additional research to determine the reason for it. However, an increasing ratio over a long period of time could also indicate that the company is not reinvesting money back into its business. This could result in a lower growth rate and lower earnings for the company in the long term. An accrued expense is an expense your business has incurred but hasn’t yet paid. Expenses that have been accrued will hit your AP account, showing that you have a liability for those accruals.

In and of itself, knowing your accounts payable turnover ratio for the past year was 1.46 doesn’t tell you a whole lot. Meals and window cleaning were not credit purchases posted to accounts payable, and so they are excluded from the total purchases calculation. The inventory paid for at the time of purchase is also excluded, because it was never booked to accounts payable.

With the right tools and strategies in place, you can elevate your company’s financial performance and pave the way for a brighter future. To calculate average accounts payable, divide the sum of accounts payable at the beginning and at the end of the period by 2. Net credit purchases figure in the denominator is not easily discoverable since such information is not usually available in financial statements.

When auditors look at accounts payable, they’ll want to see that you’re following AP best practices. Following these guidelines can make the auditing process go a lot more smoothly. Your accrual report will show all your accrued expenses for a specific period, irrespective of payment activity.